Gold Price Fintechzoom: Forecast and Investment Strategies

In this article on Fintechzoom, we’ll analyze the factors currently influencing gold price and what potential investors might expect moving forward. By examining economic indicators, geopolitical tensions, and currency fluctuations, we can offer insights into how these elements may influence gold in the coming year. Additionally, we’ll provide expert predictions on the price trajectory of gold for 2024, along with strategic investment tips tailored for both seasoned and novice gold investors.

Gold and Silver have long been considered a bastion of security in the unpredictable world of investing. Its allure stems not just from its physical beauty but from its historic role as a hedge against inflation and economic instability. In recent times, particularly heading into 2024, gold price have shown remarkable volatility, capturing the attention of investors and Fintechzoom analysts alike.

Fintechzoom Current Gold Price Analysis

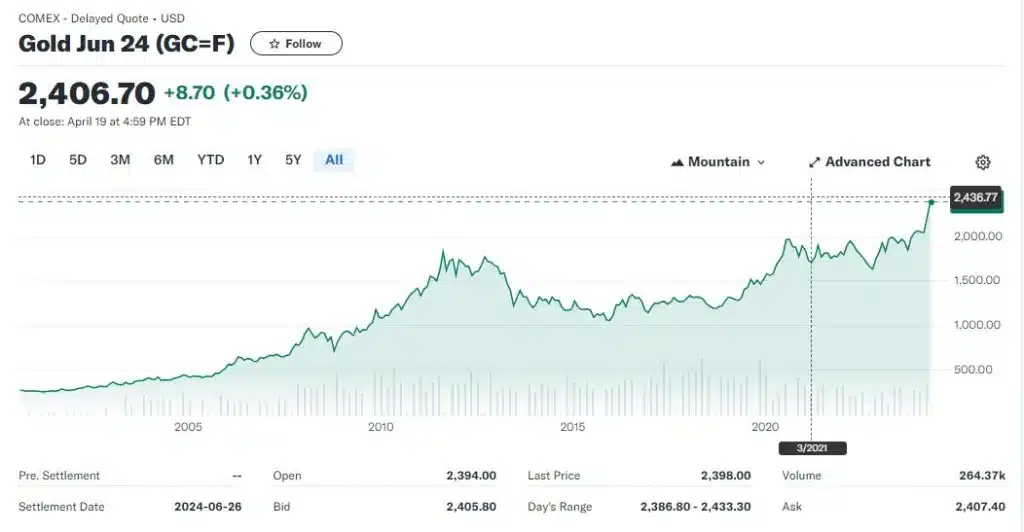

As of April 2024, the gold market is demonstrating dynamic activity with recent pricing showing gold at approximately $2,169.70 per ounce. This marks a slight decline, reflecting minor volatility in the precious metals market.

Gold prices reached an all-time high of $2,135.39 per ounce at the end of 2023, driven by a combination of a weakening U.S. dollar and anticipations of rate cuts by the Federal Reserve. These factors continue to play a significant role in the gold market dynamics observed in 2024. Current expectations suggest that the Fed may implement interest rate cuts, which historically have bolstered gold prices due to the metal’s appeal as a non-yielding asset becoming more attractive when interest rates decrease.

The global economic and geopolitical climate continues to influence gold prices significantly. Economic uncertainties and ongoing geopolitical tensions, such as the situations in Israel-Hamas and Russia-Ukraine, have prompted investors to turn to gold as a safe-haven asset. This trend is expected to sustain, with potential spikes in gold prices if these conflicts escalate or new issues arise.

Furthermore, technical analyses and market sentiment indicators suggest that while there might be minor retracements in gold prices in the short term, the overall trend for 2024 points towards a bullish market for gold, potentially reaching new highs later in the year or in 2025, with forecasts predicting peaks around $2,300 per ounce.

This analysis incorporates insights from multiple financial institutions and market analysts including Fintechzoom, indicating a robust interest in gold as both a safe haven and a hedge against potential economic downturns and inflationary pressures. As the economic landscape evolves and the impact of the Federal Reserve’s policies unfolds, these factors will critically determine gold’s price trajectory in the near to medium term.

Which Factors Influence Gold Price?

Economic Indicators

Global economic indicators significantly shape the trajectory of gold prices in 2024, with the U.S. Federal Reserve’s monetary policy playing a key role. The Fed’s signaling of a shift toward cutting interest rates in response to moderating inflation, expected to fall below 3%, enhances the appeal of gold. Historically, lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, thus boosting its attractiveness. For instance, in late 2023, as the Fed funds rate reached its highest in over two decades, gold prices surged to record highs in anticipation of rate cuts.

Further influencing gold prices are inflationary trends. Although we anticipate a cooling down of inflation, its previous peaks have already established a precedent that supports a bullish outlook for gold into 2024. Experts consider this scenario particularly likely if inflation rates do not stabilize as quickly as forecast.

Geopolitical Tensions

Geopolitical risks also play a critical role in gold price dynamics. For example, ongoing conflicts such as those in Ukraine and the Middle East have historically led to increased investments in gold, as investors seek safety in the face of uncertainty. The general instability and the unpredictable outcomes of such conflicts tend to push more investors towards gold, reinforcing its status as a safe-haven asset.

Currency Fluctuations

The strength of the U.S. dollar is another pivotal factor. Gold, being denominated in dollars, becomes cheaper for holders of other currencies when the dollar weakens, thus driving up demand. Throughout 2023, the U.S. dollar’s fluctuations closely mirrored shifts in gold prices. The dollar’s weakening, due to the Fed’s monetary easing and geopolitical uncertainties, buoyed gold prices. As we move into 2024, experts expect this inverse relationship between the dollar and gold prices to continue, especially if the dollar keeps declining amidst further rate cuts and global political unrest.

Each of these factors interlinks to form a complex but discernible pattern influencing gold prices. Understanding these relationships provides a strategic advantage in predicting gold’s price movements and making informed investment decisions.

Fintechzoom Gold Price Forecast

A confluence of Fintechzoom analyses and economic models shapes the forecast for gold prices in 2024. Various financial institutions and market experts including Fintechzoom have provided their insights into where they believe gold price will head in the upcoming year, with predictions largely influenced by the anticipated macroeconomic conditions and monetary policies.

For instance, major banks such as Goldman Sachs and J.P. Morgan forecast gold prices to hover around $2,050 to $2,175 per ounce respectively by the end of 2024. These projections are supported by the expectation of continued monetary easing by the U.S. Federal Reserve and other central banks. Additionally, J.P. Morgan emphasizes the role of geopolitical tensions and economic uncertainties in driving gold prices higher, anticipating that these factors will sustain investor interest in gold as a safe haven.

In contrast, more bullish predictions come from analysts like Ronald Stoeferle from Incrementum AG, who suggests that gold could reach as high as $2,500 per ounce by the end of 2024. Figures such as Robert Kiyosaki and Zach Scheidt mirror this optimism with even higher forecasts, speculating that prices could surge to $5,000 and $3,000 per ounce respectively, due to severe economic disruptions and significant monetary inflation.

Such diverse predictions underscore the complexity of forecasting gold prices, which depend on a myriad of intertwined factors including global financial stability, currency strengths, investor sentiment, and central bank policies. The consensus, however, leans towards a generally bullish outlook for gold in 2024, buoyed by the prevailing economic uncertainties and the traditional role of gold as a stabilizing asset during turbulent times.

Fintechzoom Gold Price Investment Strategies

As we look towards 2024, the strategies for investing in gold must be informed by both the forecasts and the underlying factors that might influence its price. Given the expected volatility and the various bullish predictions, there are several approaches investors might consider to optimize their exposure to gold.

Diversification through Gold

One key strategy is the diversification of an investment portfolio to include gold. This can be done through physical gold, gold ETFs, or gold mining stocks. Each option has its nuances; physical gold offers tangible security, ETFs provide liquidity and ease of trading, and stocks in mining companies might offer leveraged exposure to gold prices. For instance, as gold prices increase, gold mining companies often see a boost in profitability, potentially leading to higher stock prices.

Strategic Entry and Exit Points

Timing the market can be challenging but having strategic entry and exit points can help in maximizing returns. Based on the cyclic nature of gold prices and the expected dips and rises as noted by financial experts, investors might look to buy during anticipated short-term decreases and sell during high peaks. For example, analysts have noted potential retractions in gold prices in early 2024, which might provide a good buying opportunity, followed by an expected rise towards the end of the year.

Hedging Against Inflation and Currency Devaluation

Gold has historically been an excellent hedge against inflation and a falling dollar. With the projected decrease in real interest rates and the potential weakening of the dollar, gold could serve as a protective asset against eroding purchasing power.

Monitoring Geopolitical and Economic Indicators

Given gold’s sensitivity to geopolitical events and macroeconomic indicators, staying informed about these can provide critical insights into when to adjust your gold holdings. For instance, escalating conflicts or unexpected economic downturns generally increase gold’s appeal, prompting a strategic increase in gold investment.

In summary, while the inherent risks of commodity investment remain, the strategic acquisition of gold in 2024 can serve not only as a safeguard against uncertainty but also as a potentially profitable venture. Investors should remain vigilant, monitoring both market signals and broader economic indicators to inform their decisions.

Risks and Considerations

Investing in gold, like any asset, comes with its set of risks and considerations that must be meticulously evaluated to avoid potential pitfalls. Here are some key factors that investors should consider before committing capital to gold in 2024.

Market Volatility

Gold prices can be highly volatile, influenced by a range of factors from global economic conditions to central bank policies and geopolitical tensions. This volatility can lead to significant price swings, which, while offering the potential for high returns, also come with an increased risk of losses. Investors need to be prepared for the possibility of sudden market movements that could adversely affect the value of their gold holdings.

Liquidity Concerns

While certain forms of gold, like ETFs, are highly liquid, physical gold can sometimes be more challenging to sell quickly at market prices. This is particularly true in times of crisis when liquidity can dry up, and selling prices may be lower than expected.

Opportunity Cost

Investing in gold does not offer yield in the form of dividends or interest, unlike other investments such as bonds or dividend-paying stocks. The opportunity cost of holding gold becomes particularly pronounced in times of market boom when other assets may provide substantial returns.

Storage and Insurance

For those investing in physical gold, storage and insurance are important considerations. Secure storage can be costly, and insurance can add to the expense, reducing the overall profitability of gold investments.

Economic Conditions

While gold is often seen as a safe haven during economic downturns, its price can be adversely affected by improvements in the economic environment. For example, if inflation fears ease more quickly than expected or if global economic conditions improve significantly, gold’s appeal may diminish, leading to price decreases.

Regulatory and Political Changes

Changes in regulations or shifts in political climate can affect gold prices. For instance, a new regulation that affects mining operations can increase production costs and impact gold supply. Similarly, political stability or instability in countries that are major gold producers can influence market sentiment and affect prices.

Investors considering gold must weigh these risks against potential benefits, keeping in mind their personal risk tolerance and investment goals. It’s crucial to conduct thorough research or consult with financial advisors to make well-informed decisions.

Frequently Asked Questions (F.A.Q)

What drives the price of gold according to Fintechzoom?

Several factors, including U.S. Federal Reserve policies, inflation rates, geopolitical tensions, and currency fluctuations influence the price of gold. Lower interest rates typically make gold more attractive as they reduce the opportunity cost of holding non-yielding assets. Additionally, during times of economic uncertainty or geopolitical strife, gold is often sought as a safe haven, which can drive up prices.

Is gold a good investment in 2024?

Given the current economic indicators and expert predictions, gold appears to be a favorable investment for 2024. Financial institutions project a bullish outlook due to expected continued monetary easing, potential geopolitical unrest, and ongoing inflation concerns. However, as with any investment, it is important to consider one’s own financial situation and risk tolerance.

How do interest rates affect gold prices?

Interest rates have an inverse relationship with gold prices. When interest rates are low, the opportunity cost of holding gold decreases, making it more attractive. This is because gold does not yield interest or dividends. Conversely, when interest rates rise, other investments that yield interest become more appealing, which can lead to lower gold prices.

Can geopolitical events influence gold prices?

Yes, geopolitical events significantly influence gold prices. Gold is often viewed as a safe-haven asset, so during times of geopolitical uncertainty, demand for gold increases as investors look for stability. This increased demand can drive up gold prices, as seen during times of conflict or economic sanctions.

Wrapping Up

To conclude, different factors, from shifting economic indicators and central bank policies to ongoing geopolitical tensions, position the gold market in 2024 at a critical juncture. For investors considering gold, the outlook remains generally bullish, though inherent risks and volatility typical of precious metals accompany it. Given its historical performance as a safe-haven asset, gold continues to be an attractive option for portfolio diversification, especially in uncertain economic times.

![Fintechzoom Bitcoin Price Analysis and Predictions [2024]](https://thefintechzoom.com/wp-content/uploads/2024/04/Fintechzoom-Bitcoin-Price-768x432.webp)