Fintechzoom Microsoft (MSFT) Stock 2024: Ratings and Future

Microsoft Corporation (MSFT), a global leader in technology, has continuously evolved to meet the demands of a rapidly changing digital landscape. Established in 1975, Microsoft has expanded its offerings from operating systems to a comprehensive suite of cloud computing services, productivity applications, and more. The company’s influence extends across various sectors, including software, hardware, and artificial intelligence (AI), making it a critical player in the tech industry. In this article on Fintechzoom, we’ll guide you through Microsoft (MSFT) stock performance, financial analysis, and future outlook.

Recent developments have seen Microsoft pushing the boundaries of innovation, particularly in AI. The company is set to unveil new AI tools for PCs and cloud services at its upcoming Build conference, signaling a strong commitment to advancing AI technology. Additionally, Microsoft’s strategic maneuvers, such as the renewed partnership with NetEase, promise to strengthen its position in the global market by reintroducing popular video games like “World of Warcraft” in China, the world’s largest gaming market.

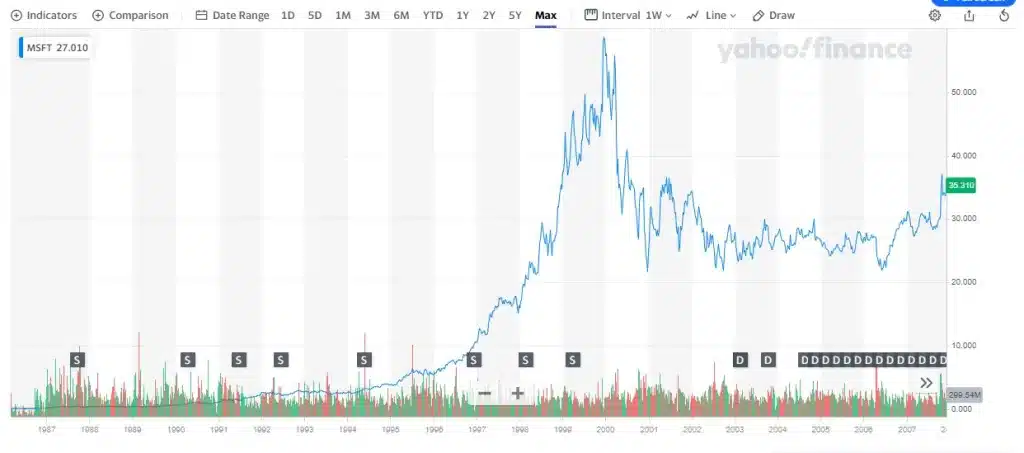

MSFT Stock Performance Overview

Microsoft’s stock performance has been a focal point for investors, reflecting the company’s strong market position and consistent growth. As of early 2024, Microsoft’s stock price hovered around $411, marking a significant rise from previous years. This increase can be attributed to the company’s solid financial performance, innovative product launches, and strategic acquisitions that have bolstered its market share and revenue streams.

In the broader market context, Microsoft has outperformed many of its peers in the technology sector. The company’s stock has shown resilience and growth amidst various market fluctuations, often outpacing the S&P 500 index. This performance is a testament to Microsoft’s robust business model, diversified product portfolio, and its ability to generate steady revenue and profit growth.

The company’s stock has been buoyed by positive analyst ratings and optimistic price targets. For instance, analysts have set price targets ranging from a low of $306 to a high of $600, with an average around $432. These targets indicate a general confidence in Microsoft’s future growth trajectory, supported by its strong financial fundamentals, market-leading product offerings, and strategic initiatives in high-growth areas such as cloud computing and artificial intelligence.

Financial Analysis of Microsoft

Microsoft’s financial health is robust, evidenced by its impressive revenue and earnings growth. In the fiscal year 2023, Microsoft reported a revenue increase of 17.55%, from $211.92 billion to an estimated $249.11 billion. This growth trajectory is expected to continue, with forecasts predicting revenue to reach $284.78 billion by 2025, highlighting the company’s strong market position and operational efficiency.

Earnings per share (EPS) also reflect Microsoft’s financial strength, with an increase from $9.68 to $11.89, marking a 22.85% rise. This trend is anticipated to persist, with EPS projected to grow to $13.63 in the next fiscal year, signifying healthy profitability and financial stability. These figures underscore Microsoft’s ability to generate increased profits, which is a key driver for stock performance and investor confidence.

Microsoft’s financial robustness is further supported by its strategic investments in growth areas such as cloud computing, AI, and gaming. For example, the company’s significant investment in AI data centers in Japan indicates a forward-looking approach to capitalizing on emerging tech trends. Such investments not only fuel revenue growth but also enhance Microsoft’s competitive edge in the global market.

Fintechzoom MSFT Stock Ratings

Analyst sentiment around Microsoft’s stock is predominantly positive, reflecting confidence in the company’s market position and future prospects. The consensus among analysts is a “Strong Buy,” based on the comprehensive reviews of various financial institutions. For instance, Wedbush maintains a “Buy” rating with a price target of $500, suggesting a potential upside from current levels. Similarly, UBS and Jefferies advocate a “Strong Buy,” with price targets of $480 and $550, respectively, indicating bullish outlooks for MSFT’s stock performance.

These optimistic ratings are grounded in Microsoft’s consistent financial performance, strategic growth initiatives, and strong foothold in the technology sector. Analysts highlight the company’s ability to leverage its cloud computing and AI advancements, which are expected to drive revenue and profit growth. The broad range of price targets, from as low as $306 to as high as $600, reflects differing opinions on the stock’s future trajectory, yet the average target around $432 suggests a general expectation of growth.

The ratings are also influenced by Microsoft’s strategic decisions, such as its investments in AI and cloud services, and its ability to adapt to changing market dynamics. For example, the company’s expansion in the Japanese market with a $2.9 billion investment in AI data centers is seen as a positive move that enhances its global competitiveness.

Fintechzoom Price Target and Forecast for Microsoft (MSFT) Stock

Fintechzoom closely watching MSFT stock, with price targets reflecting an optimistic outlook. Fintechzoom Analysts have set a range of price targets for MSFT stock, with the average landing at approximately $432.18, signifying a modest increase from current levels. This average target is supported by high estimates reaching up to $600, showcasing some analysts’ high expectations for Microsoft’s growth potential.

The positive sentiment is driven by Microsoft’s strong market presence, continuous innovation, and strategic investments, particularly in AI and cloud computing. These factors are anticipated to fuel future revenue and earnings growth, justifying the higher price targets. However, the range also includes lower estimates, such as $306, indicating that some analysts remain cautious about potential challenges or market volatility affecting the stock’s performance.

The consensus among analysts points towards a “Strong Buy” rating, suggesting that Microsoft is well-positioned to outperform the market. This consensus is backed by a detailed analysis of the company’s financial health, market trends, and strategic initiatives, which are expected to drive Microsoft’s stock performance in the upcoming months.

Investment Risks and Considerations

Investing in Microsoft, like any stock, comes with its set of risks and considerations. While the company has shown strong financial performance and strategic growth, investors must be aware of potential challenges that could impact its stock value. Key risks include market competition, technological shifts, and regulatory changes.

Competition is fierce in the technology sector, with companies constantly innovating to gain market share. Microsoft faces significant competition from other tech giants in cloud computing, software, and AI. These competitors could affect Microsoft’s market position if they launch superior products or services or engage in aggressive pricing strategies.

Technological shifts pose another risk. The tech industry evolves rapidly, and companies must continuously innovate to stay relevant. Microsoft’s future growth depends on its ability to lead or adapt to technological advancements. Any failure to keep up with technological changes or consumer preferences could negatively impact its financial performance.

Regulatory challenges are also a concern, particularly in areas related to data privacy, cybersecurity, and antitrust regulations. Changes in laws and regulations could impose additional costs, limit business practices, or affect the company’s operations in significant markets.

Despite these risks, Microsoft’s diversified business model, strong financial foundation, and strategic investments in high-growth areas like AI and cloud computing mitigate these concerns to some extent. Investors should, however, closely monitor these factors to make informed decisions.

Frequently Asked Questions (F.A.Q)

What was Microsoft’s stock price range over the past 12 months?

Microsoft’s stock price fluctuated between $273.13 and $430.82 in the past year, showcasing the stock’s volatility and the market’s dynamic response to the company’s performance and broader economic factors.

Does Microsoft pay dividends?

Yes, Microsoft pays quarterly dividends. The company’s annual dividend yield is around 0.67%, with a quarterly payout of $0.75 per share, highlighting its commitment to returning value to shareholders.

When is Microsoft’s next earnings report date?

Microsoft is scheduled to release its next earnings report on April 23, 2024. These reports are closely watched as they provide insight into the company’s financial health and future outlook.

How did Microsoft’s earnings perform last quarter?

In its last quarterly report, Microsoft announced earnings of $2.93 per share, exceeding the consensus estimate of $2.771. This beat reflects the company’s strong financial performance and operational efficiency.

Is Microsoft considered overvalued or undervalued?

Based on current analyst assessments, Microsoft’s stock is considered undervalued. This evaluation is based on the company’s financial performance, market position, and future growth prospects in comparison to its current stock price.

What is Microsoft’s current EPS estimate?

The estimated earnings per share (EPS) for Microsoft is $2.81, which is a critical metric used by investors to gauge the company’s profitability relative to its stock price.

How many shares outstanding does Microsoft have?

Microsoft has approximately 7,430,436,000 shares outstanding, reflecting the total number of shares that are currently held by shareholders, including institutional investors and company insiders.

Wrapping Up

Microsoft Corporation (MSFT) stands as a titan in the technology sector, showcasing a strong financial performance, strategic market positioning, and a robust portfolio of products and services. The company’s stock performance has been commendable, with a notable increase in its price, reflecting investor confidence and market approval of its strategic directions and growth initiatives.